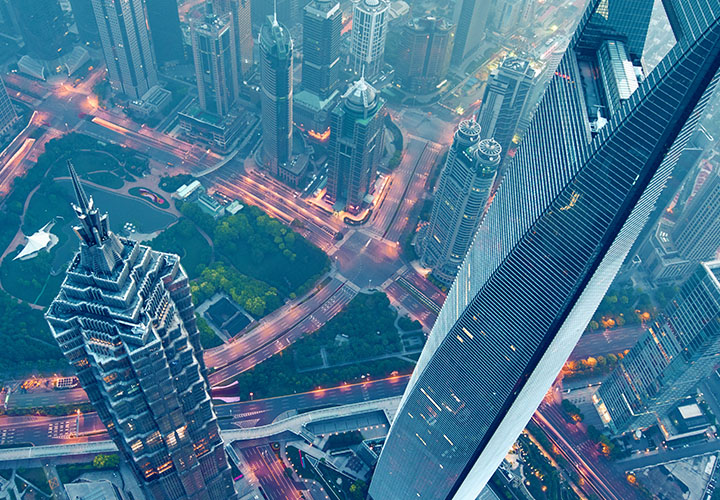

In many respects this looks like a time of opportunity. Growth has returned to major economies, business confidence is on the rise across the United States and Asia, and China is increasingly opening its markets to the world.

However the global recovery has been largely aided by government stimulus on an unprecedented scale, which has pushed interest rates to historic lows and left investors struggling to find yield. Questions persist about the ability of central banks to soft-land their economies, triggering uncertainty around monetary policy, while fears of a global trade war and geopolitical unrest mean market volatility is an ever-present risk.

Amid such conditions it’s crucial to identify the trends that will fuel long-term future growth, and shape investment strategies accordingly. The technology sector, which outperformed most major markets in 2017, is poised to unleash the disruptive impact of artificial intelligence (AI) and build shareholder value by empowering companies to innovate, and to enhance productivity and profitability.